The longer the term of your loan, the longer it takes to pay down your principal amount borrowed, and the more you will pay in total toward interest. As a result, each payment has a different impact on your mortgage balance. You can create it in Excel by using the PMT function to calculate the payment amount. The energy amortization period is the time it takes for an energy system to generate the amount of energy required for its manufacture, installation and disposal. The amortization should be high enough to ensure that the loan is repaid in full within the agreed term without exceeding the financial burden. This table provides an overview of the advantages and disadvantages of amortization in general and helps to evaluate how amortization can affect various financial aspects.

Credit and Loans That Aren’t Amortized

By understanding the details provided in the tables, borrowers and lenders can make more informed decisions that can lead to significant savings over the lifetime of a amortization explained loan. This edition also includes examples and explanations on how to adapt the tables for use with different types of loans, making it a versatile tool for personal and professional finance management. The term’s got a fancy ring, but it’s just an accounting technique used to gradually lower the book value of a loan or intangible asset over time. Think of it like slicing up your loan into bite-sized monthly payments, making it easier to chew over, say, 30 years.

How mortgage amortization works, and why it matters

The amortization period, also known as the “payback period”, is the period of time required to repay an investment or loan in full. It is an important indicator of the Rate of Return of an investment and provides information on how long it takes for the initial costs to be covered by the income generated. However, for some, these loan payments happen over a long period — it can be a very slow and drawn-out process. Depending on the payment method used, some payment periods can be quite high, causing cash flow issues within the business.

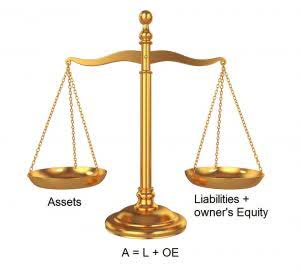

- Amortization is an accounting term used to describe the act of spreading out the expense of a loan or intangible asset over a specified period with incremental monthly payments.

- The expense would go on the income statement and the accumulated amortization will show up on the balance sheet.

- Besides amortization, there are several other ways to structure loan payments.

- This is in accordance with the matching principle, which requires that expenses be matched with the revenue they generate.

- Like fixed-rate mortgages, auto loans have a fixed interest rate and regular monthly payments.

- There are many instances where companies need to take out a loan or pay off assets over multiple accounting periods.

How to Read Your Schedule K-1 Tax Form

The useful life of an intangible asset cannot exceed 15 years, and the asset must have a determinable useful life. Goodwill, for example, cannot be amortized because it has an indefinite useful life. Amortization reduces the value of the intangible asset on the balance sheet and increases the expense on the income statement. Amortization is a term that is often used in the world of finance and accounting. It refers to Retail Accounting the process of spreading out the cost of an asset over a period of time. This can be useful for businesses and individuals who want to make large purchases but cannot afford to pay for them all at once.

Over time, the interest component decreases while the principal component increases. However, even though the principles behind amortization and depreciation might seem similar, they are applied to different types of assets. Depreciation is used for tangible assets, such as machinery, buildings, or equipment. These types of assets have a physical presence and their value decreases over time due to physical wear and tear, among other factors. The straight-line method of amortization is one of the simplest methods.

Difference between Break Even Point, Amortization, Depreciation

Before taking out a loan, you certainly want to know if the monthly payments will comfortably fit in the budget. Therefore, calculating the payment amount per period is of utmost importance. Like the wear and tear in the physical or tangible assets, the intangible assets also wear down.

We Care About Your Privacy

Did you know that each payment you make on an amortized loan is like a mini income summary financial expedition? At the start, you’re battling through the thick forest of interest, whacking down those pesky interest payments left and right. But as time marches on, you emerge into the clearing of the principal amount. It’s like making your way through an overgrown jungle till you find the treasure chest! This magical transformation happens thanks to your loan’s amortization schedule. A mortgage calculator can show the amortization schedule for a fixed-rate loan.